Welcome to the first edition of The Pointillist, a quick-fire collage of new reports, links, insights, journal articles, charts, and other things that caught my attention in recent weeks. Enjoy!

The New Zealand Government has released a first-cut of its Adaptation Framework. With only two pages of content, it leaves a lot unsaid, but begins to narrow the uncertainty over government's position.

The accompanying Cabinet Paper shines a little more light on the issue of cost-sharing, which I discussed earlier in The Shift #1: Who pays, and who makes them pay, for climate adaptation. It expresses a preference for the Independent Reference Group (IRG) recommendation of a beneficiary-pays approach, with the Crown investing where it realises a benefit, or 'to help communities in highest risk areas but without the ability to pay.' However, it defers until next term any substantive decisions on long-run Crown financial assistance. In the nearer term, a forthcoming ministerial response to the IRG seeks to increase clarity – with a clear intent to be more discriminating and less magnanimous in Crown financial assistance. The relevant section is reproduced below.

I recommend these reflections from Josh Ryan-Collins on the measure-to-manage paradigm of sustainable finance, exemplified by Mark Carney’s ‘tragedy of the horizons’ speech. While critical of the underlying presumption that the market will do what is necessary once it has better information, Ryan-Collins’s recommendations build upon the foundations of this paradigm, extending the tools of disclosures, taxonomies and transition plans into macroprudential and credit guidance policies.

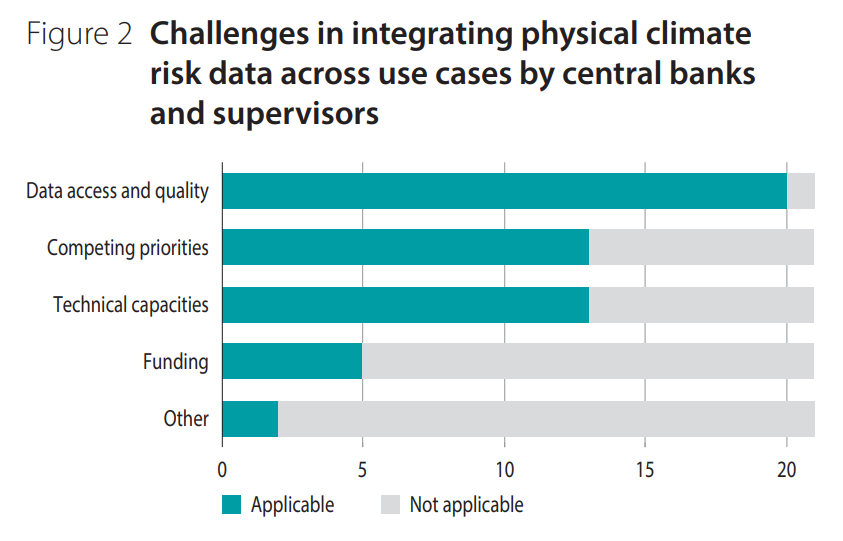

Speaking of the measure-to-manage paradigm, the Network of central banks and financial supervisors for Greening the Financial System (NGFS) has released a new report on climate risk data. A survey of NGFS members across all continents finds the greatest challenge is data access and quality.

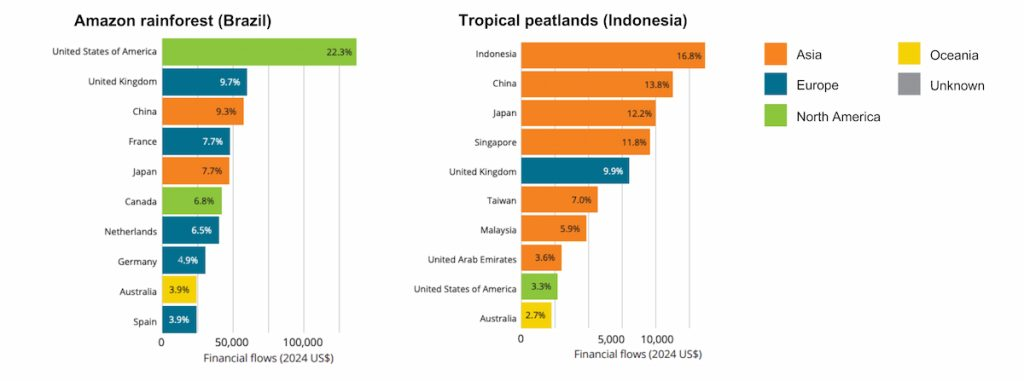

On nature-related risk, the London School of Economics and Political Science (LSE) has launched Earth Capital Nexus (EarthCap), a global research initiative led by Professor Nicola Ranger (the author of many marvellous contributions on adaptation, nature and finance). It is described as 'a global initiative to make nature visible in the financial system and unlock trillions in sustainable investment into restoration and recovery.' Watch this space.

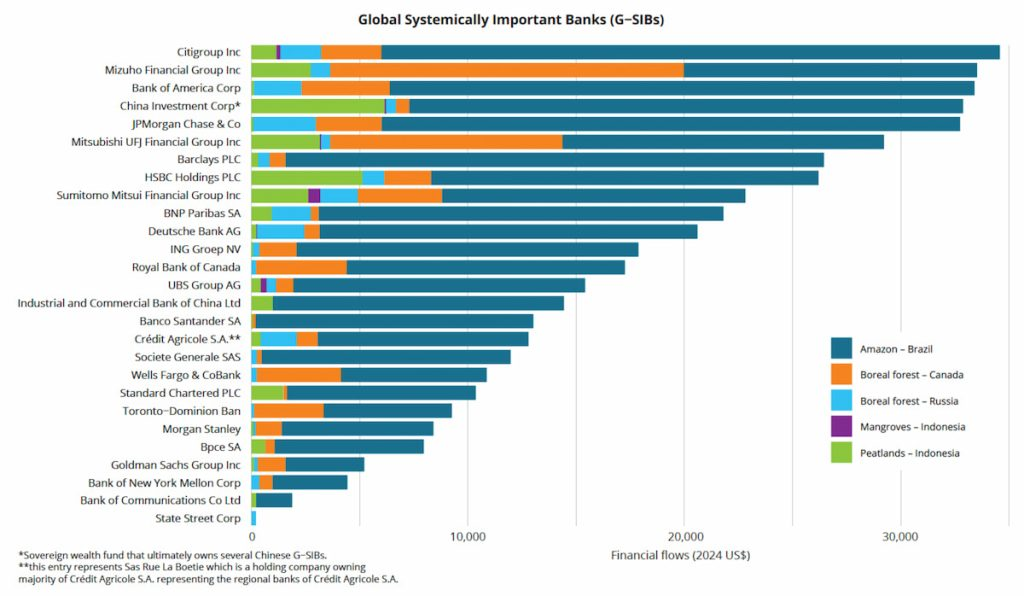

See the charts below from new research on the source of financial flows into critical ecosystems...

... and exposure of globally systemic important banks (GSIBs) into the Amazon rainforest in Brazil; boreal forests in Canada and Russia; and mangroves and tropical peatlands in Indonesia.

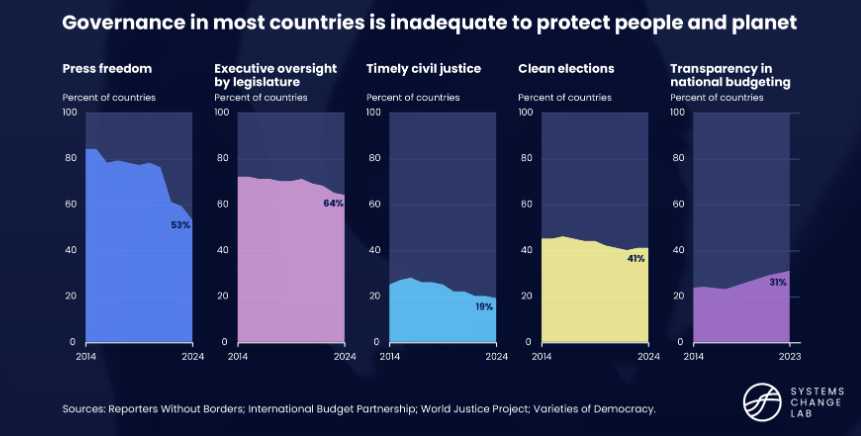

A new data set on governance from the Systems Change Lab. The steep global decline in press freedom is notable.

Finally, in case you missed it, the Frontier Economics review of electricity market performance has dropped. Hard to escape the dissonance between Frontier’s characterisation of LNG as ‘a last resort’ and the New Zealand Government’s same-day announcement that: ‘The Crown will commence procurement of LNG infrastructure.’

In light of the LNG mandate, the ministerial promise of equity injections for gentailer investments, and the $200m allocated to public subsidies for new gas field developments in the last budget, I couldn't resist the opportunity for a cheeky meme...

Thanks for reading this far! If you haven't already, please subscribe to receive future content like this, as well as essays and transition-related briefings.